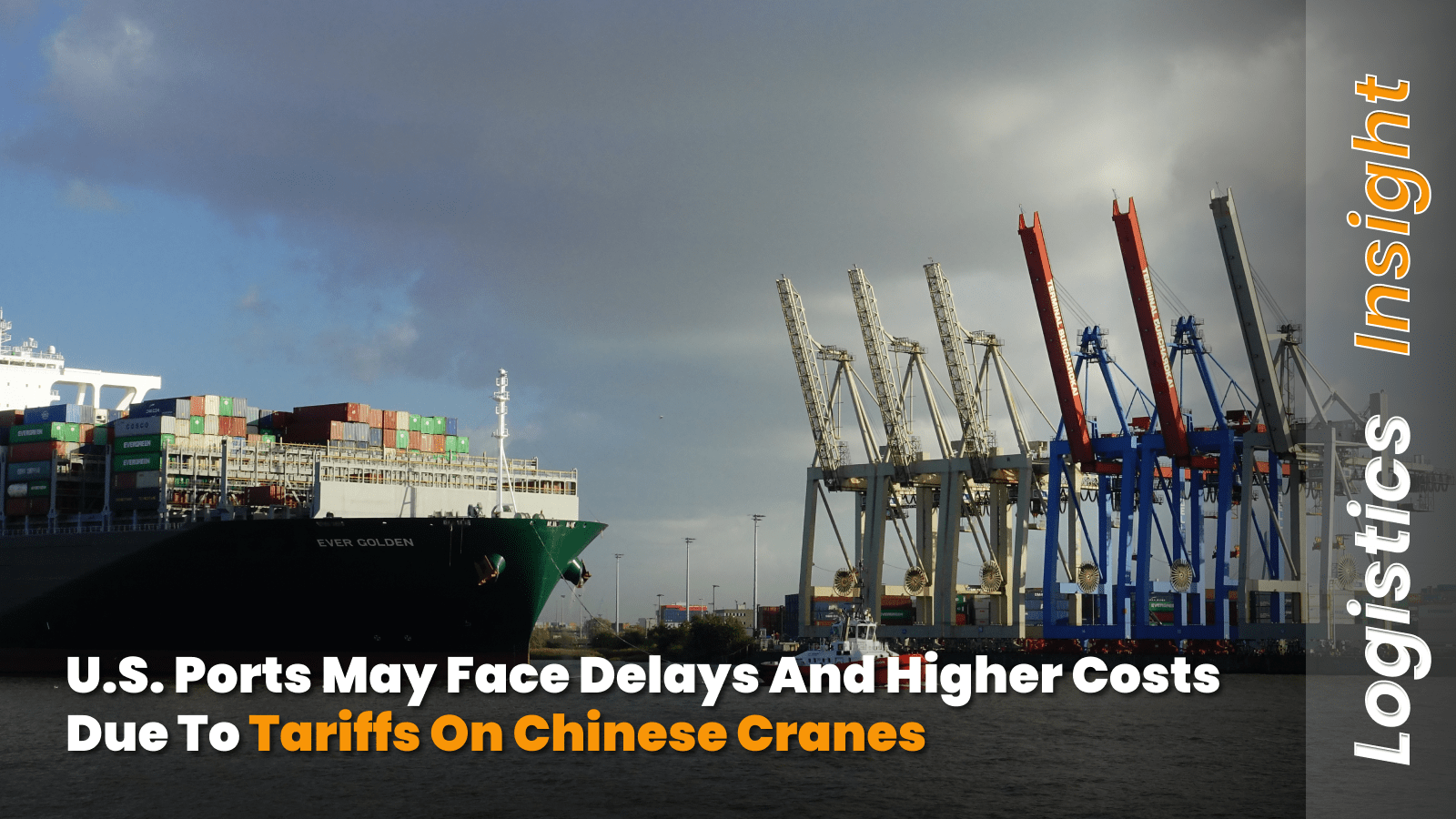

Trump’s Tariff Plans on Chinese Cranes Could Disrupt U.S. Port Operations

The Trump administration is taking aim at Chinese-manufactured ship-to-shore cranes in its latest push to revitalize U.S. manufacturing. A new proposal from the U.S. Trade Representative (USTR) suggests tariffs of up to 100% on cranes, shipping containers, and related components imported from China—despite the absence of a domestic industry to replace them.

Currently, there are no U.S.-based manufacturers of these specialized cranes, and establishing such a supply chain could take at least a decade, according to Gene Seroka, Executive Director of the Port of Los Angeles. While European and Japanese alternatives exist, Seroka notes the options are “very slim,” with added hurdles such as workforce training, infrastructure investment, and rising costs of raw materials like steel and aluminum—which themselves are also affected by existing tariffs.

These proposed duties could further strain an already niche sector, narrowing choices for U.S. marine terminal operators and driving up operational expenses. Although most cranes have a lifespan of 20 years and immediate impacts may be limited, long-term concerns center on reduced market flexibility and cost escalation, which may be passed down through the supply chain to end consumers.

Ship-to-shore cranes play a critical role in the logistics ecosystem, transferring containerized goods—such as electronics, plastics, and furniture—between vessels, trucks, and railroads. On the export side, common goods include wood pulp and oilseeds. With Chinese-made cranes widely used across major U.S. ports and featuring remote programming capabilities, national security concerns have also come into focus. The Biden administration is likewise considering similar tariff measures.

Despite bipartisan support for domestic manufacturing, the lack of U.S. companies in this space poses a significant challenge. The American Association of Port Authorities (AAPA) has publicly opposed the proposed tariffs, advocating instead for production tax credits to support the emergence of U.S.-based cargo-handling equipment manufacturers.

Cary Davis, President of the AAPA, emphasized the risk:

“High tariffs on ship-to-shore cranes, without affordable alternatives from either domestic or allied sources, function as a crippling tax on port development and seriously threaten our nation’s ability to expand cargo movement.”

A public hearing on the proposed tariff actions is scheduled for May 19. While the USTR’s latest revision, dated April 24, reduced some planned fees on Chinese vessels, concerns persist about additional costs cascading through the supply chain.

At the Port of Los Angeles—the largest in the U.S. for containerized imports—about 40 to 45 of the 86 ship-to-shore cranes are made in China. Future maintenance and support for this equipment may also become more expensive under the new rules.

Other cargo-handling tools, such as forklifts, are less exposed to these tariffs due to the presence of more diverse manufacturing sources. Still, about 25% of this equipment at the Port of LA originates from China.

William Brauner, Vice President of Operations at Brauner International, summarized the likely outcome:

“If you’re operating a terminal and need to purchase these cranes, you’re going to build it into the cost of moving goods. The consumer, at the end of the day, ends up being the one that’s going to bear that cost.”