Ocean Rates Stay Flat on Asia-to-U.S. Routes as Blank Sailings Rise

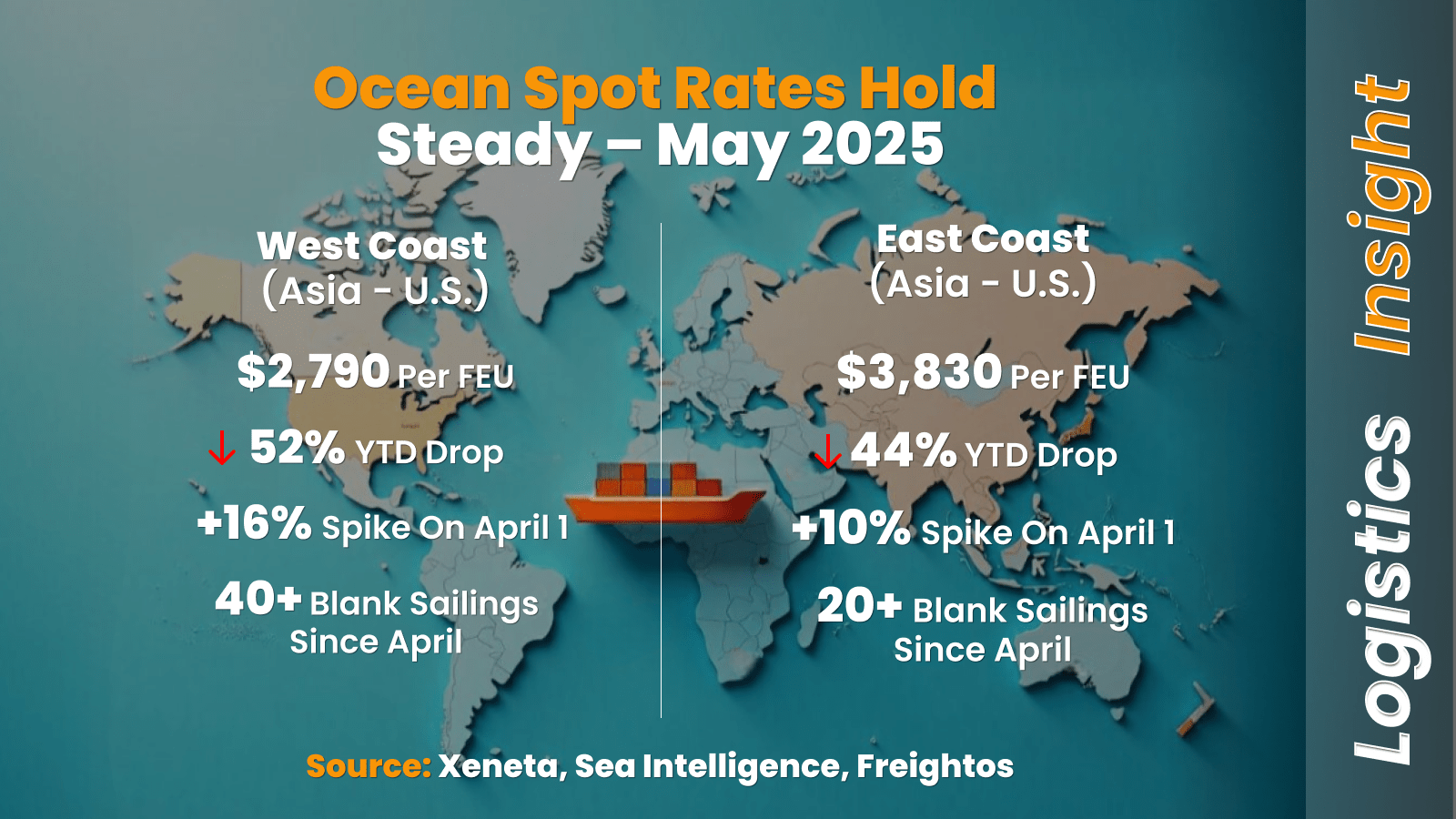

Spot rates for ocean containers from Asia to the U.S. have remained steady since mid-April, according to data from Xeneta released on May 2. The average spot rate sits at $2,790 per forty-foot equivalent unit (FEU) to the West Coast and $3,830 to the East Coast.

These rates mark a steep year-to-date drop—52% for West Coast lanes and 44% for East Coast lanes. The only significant increase this year happened on April 1, with a 16% jump for West Coast shipments and 10% for the East Coast.

Peter Sand, Chief Analyst at Xeneta, said the recent flat pricing is largely due to a spike in blank sailings out of China. Ocean carriers have responded to falling demand and new tariffs by cutting sailings, much like they did during the early stages of the COVID-19 pandemic.

Currently, Chinese goods entering the U.S. face tariffs of at least 145%, causing a steep decline in cargo volume. Freightos reported a 30%–50% drop in China-to-U.S. shipping demand in late April.

As a result, major capacity cuts are expected in the coming weeks—28% on West Coast routes and 42% on East Coast routes.

Data from Sea Intelligence shows more than 40 blank sailings between Asia and the West Coast since early April, and over 20 on East Coast routes. The week of April 21 saw the highest volume of blank sailings, with 16 canceled trips. Weekly blank sailings have averaged over 13 from mid-April to mid-May.

Earlier in Q2, many shippers rushed to move cargo before tariffs took effect, temporarily boosting port volumes. The Port of Los Angeles, for instance, handled over 2.5 million TEUs in Q1.

That rush caused a small rate bump in mid-April, but overall, spot rates have steadily declined in 2025. Experts warn that if tariffs push up consumer prices and reduce demand, ocean shipping volumes from Asia could keep falling.

Sand concluded, “The current flat spot market is probably a fairly brief interlude before the downwards trend continues.”

Comments are closed